Seasonal fluctuations in demand can pose significant challenges for small businesses. Hiring too many or too few employees can affect customer satisfaction, employee morale, and profitability. Business owners must plan ahead and optimize headcount for peak performance using predictive intelligence for small businesses.

Plan Your Headcount Effectively With Predictive Intelligence

One of the most essential factors for effective headcount planning is predictive intelligence for small businesses.

Predictive intelligence is the ability to use data and analytics to forecast future outcomes and trends. By leveraging this, small businesses can anticipate changes in customer demand, market conditions, and what their competitors are doing and adjust their staffing levels accordingly.

Predictive intelligence can also help small businesses identify the best talent for their needs and retain them for a longer time.

Machine learning can help small businesses analyze skills, preferences, and performance of their current and potential employees and match them with the most suitable roles and projects. It can also help small businesses monitor employee engagement, satisfaction, retention, provide timely feedback, recognition, and incentives.

The Role Of Budgeting and Financial Planning Software

Predictive intelligence alone isn’t enough for smart headcount planning. Small businesses also need to have a clear and realistic budget for their staffing expenses and track their actual spending against a set budget. This is where start-up budgeting and financial planning software for businesses come into play.

This software helps small businesses create, manage, and monitor their budgets and financial plans by helping them:

- Estimate their revenue and expenses and set realistic and achievable goals for their growth and profitability.

- Allocate their resources efficiently and prioritize their spending on the most critical and impactful areas of their business.

- Track their cash flow and financial performance to identify any gaps or deviations from their budget.

- Adjust their financial plan as needed and respond quickly and proactively to any changes or challenges in their business environment.

But how does SMB budget management software help small businesses with their hiring decisions? There are four ways:

- Calculate the cost and benefit of hiring new employees and compare different scenarios and options.

- Determine the optimal mix and balance of full-time, part-time and contract workers and syncing that with the best time and frequency of hiring.

- Manage their payroll, taxes, benefits, and compliance obligations, thus avoiding any penalties or fines.

- Evaluate the return on investment and impact of their employees while also optimizing their compensation and reward strategies.

The Best Budgeting Software For Small Companies

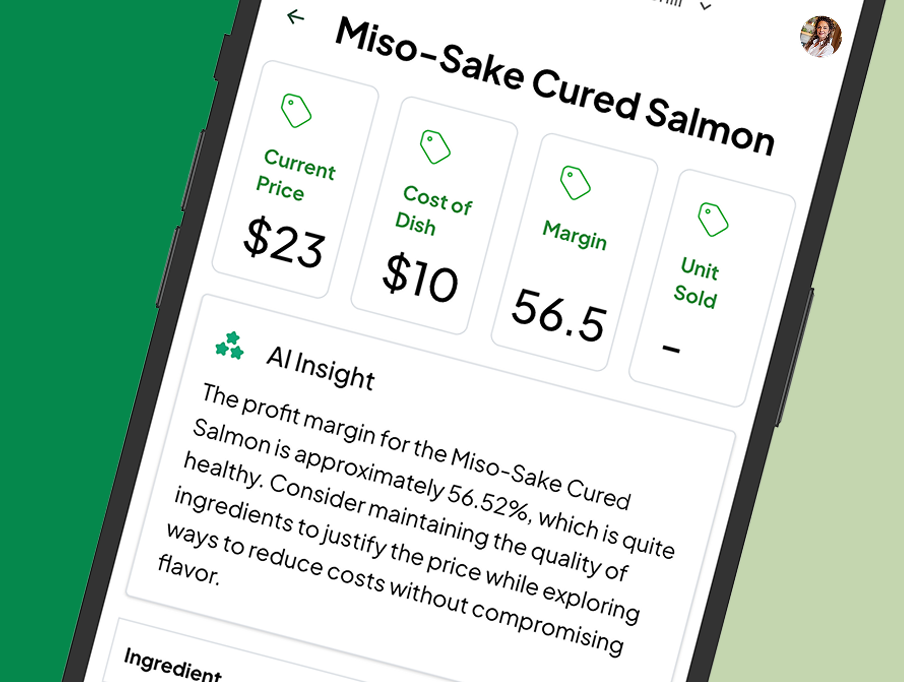

There are many types of start-up budgeting and financial planning software available in the market, catering to different needs and preferences of small businesses, but by far, the best budgeting software for small companies we’ve come across is mrgn.

Check out their financial planning software and harness the power of predictive intelligence for small businesses. Contact them today to learn more about their cloud-based service.