2 WEEK FREE TRIAL for a limited time only. Sign up today!

2 WEEK FREE TRIAL for a limited time only. Sign up today!

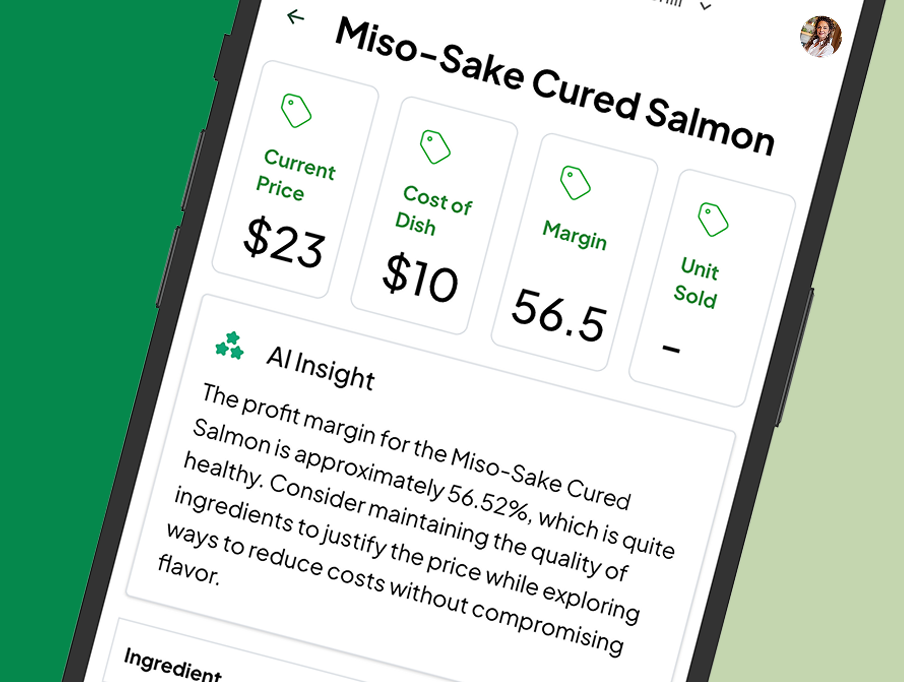

“MRGN successfully bridges the gap between large-company financial modeling and the kind of back-of-the-napkin, real-world math that small business owners like me actually do. MRGN levels the playing field.”

• • •

Owen G.

Small Business Owner

“I constantly juggle data—whether I’m tracking costs or analyzing what customers are willing to pay. The challenge is finding the sweet spot that delivers an exceptional experience while maintaining profitability. “

• • •

Wilson P.

Investor, Fine Dining

“With one location, knowing our exact margins didn’t seem worth the effort. But when we expanded to multiple locations, it became essential to fully understand the numbers. It wasn’t just about growth, it was about survival.”

• • •

Dita M.

CFO, Casual Dining

"*" indicates required fields

Unlock the complete case study. Fill out the form below to download your copy now!

"*" indicates required fields

Join the waitlist and we’ll let you know the moment we add it.