In the dynamic of modern business, managing finances efficiently is critical for success. Traditional methods of budgeting and financial planning can be time-consuming and error-prone, making it challenging for individuals and businesses to achieve their financial goals.

However, with the advent of advanced technology, there’s a solution that allows us to work smarter, not harder: budgeting software. Read on to learn more!

The Shift to Smart Budgeting

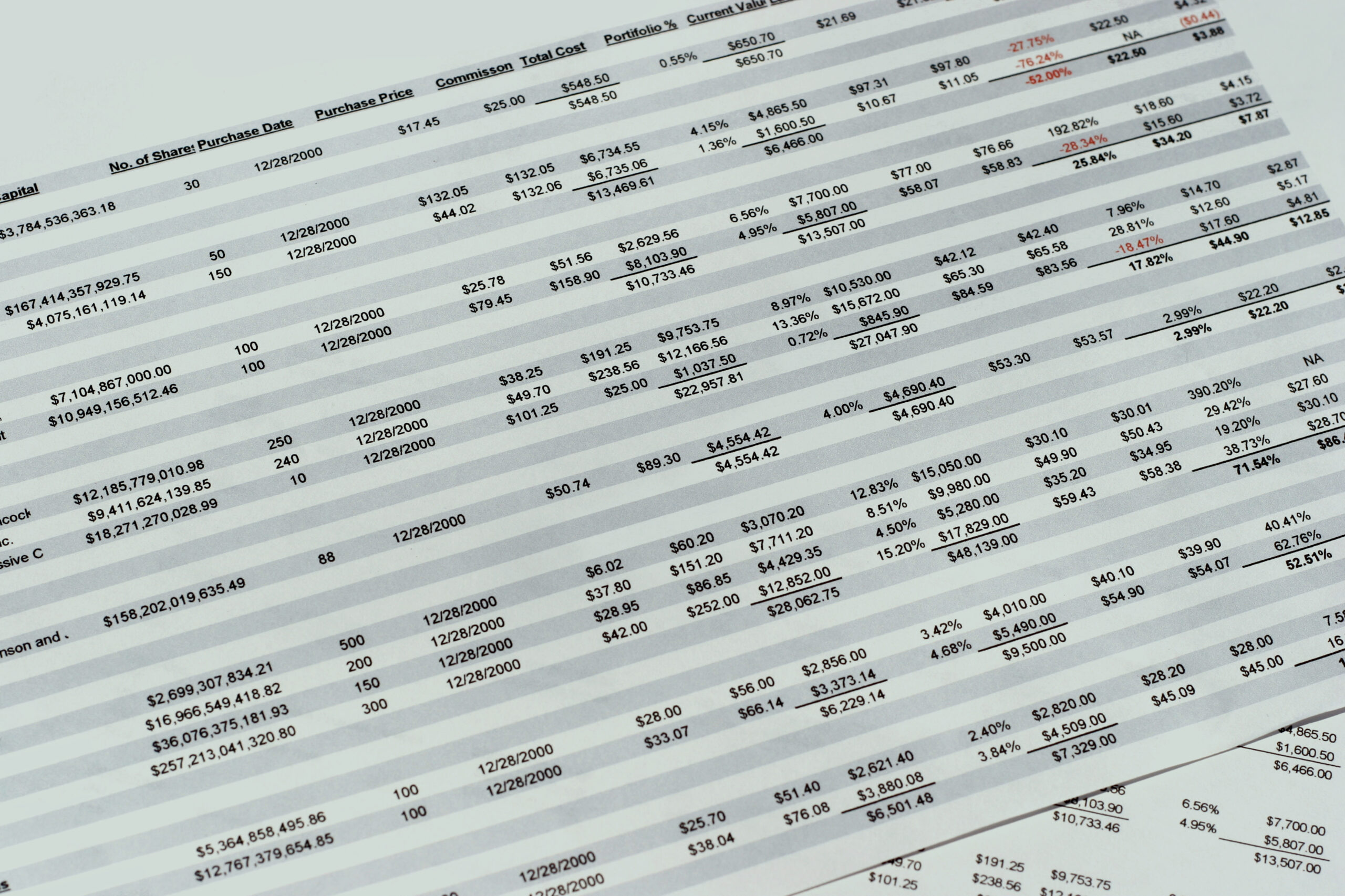

Gone are the days of manually sifting through stacks of receipts and crunching numbers on spreadsheets for hours on end. Budgeting software has emerged as a game-changer, revolutionizing the way we approach financial management. By automating tedious tasks and providing real-time insights, these tools empower users to make informed decisions, optimize spending, and achieve financial objectives more efficiently.

Benefits of Budgeting Software

Time Efficiency

Small businesses can gain substantial advantages from the implementation of small business expense tracking software. By eliminating manual data entry, entrepreneurs save valuable time for strategic endeavors.

Enhanced Security

Budgeting software provides advanced security measures, ensuring the confidentiality and integrity of your financial information. With encrypted data storage, secure logins, and regular system updates, businesses can trust that their sensitive financial details are protected from unauthorized access, bolstering overall data security and compliance with industry standards.

This added layer of security is essential for instilling confidence in users and maintaining the trust of clients and stakeholders in the landscape of small business financial management.

Accuracy and Error Reduction

Manual calculations are prone to errors, which can have significant consequences for financial planning. Small business budgeting software minimizes the risk of miscalculations, ensuring that financial data is accurate and reliable, contributing to better decision-making and overall financial health.

Real-Time Insights

Financial planning and budgeting software provide real-time insights into your financial status. This is crucial for small businesses, allowing them to adapt the market conditions and maintain financial agility. Predictive intelligence for small businesses is incorporated to ensure proactive decision-making.

Streamlined Collaboration

For businesses of any size, business budgeting software facilitates collaboration among team members and stakeholders. Multiple users can access the same data simultaneously, enhancing communication and teamwork within the organization.

Goal Tracking and Forecasting

Small business owners can leverage the forecasting capabilities of financial forecasting software integrated into budgeting tools. This allows them to monitor progress in real time, make adjustments, and achieve financial milestones.

Expense Optimization

Small businesses benefit from expense optimization features in budgeting and forecasting software. By analyzing spending patterns and trends, entrepreneurs can identify unnecessary costs and make informed decisions on where to cut back or invest more, contributing to long-term financial sustainability.

Are you a small business owner looking for an easier way to streamline your financial management? Look no further! MRGN offers an all-in-one solution for small business expense tracking software, budgeting and forecasting software, and financial planning.

With features like predictive intelligence for small businesses, our affordable small business budgeting software is tailored for SMB budget management.

With our seamless integration of small business financial management software, you can take care of hiring, finances, and other essential operations effortlessly. Start your journey by contacting us today!