With rising inflation in the US, managing finances for any business can be tricky and has never been more important. In such circumstances, business owners must focus on making effective and precise budgets to navigate any financial uncertainty.

Understanding the Significance of Precise Budgeting

If you want to analyze your company’s income, expenses, and overall financial health, creating a precise budget is necessary. The basic goal of making a budget is to achieve financial clarity and stability, while identifying opportunities for growth. Precise budgeting allows businesses to make informed decisions, minimize financial stress, and build an excellent foundation for long-term success.

An exceptional budget provides a roadmap for allocating resources effectively. It can help business owners identify areas of improvement and boost productivity. Precision budgeting also promotes proactive financial management, which can help your business handle economic fluctuations and industry challenges efficiently.

Conducting a Thorough Analysis

Before creating a budget, it is best to conduct a comprehensive analysis of your company’s financial history and market trends including an in-depth examination of your organization’s revenues and expenses. You must also focus on forecasting future financial scenarios based on market trends. Consider creating a realistic budget that anticipates future challenges and helps you utilize future opportunities.

Effective Resource Allocation

When you’re making a budget, you must make strategic decisions about where to allocate resources. As a business owner, you must prioritize expenditures based on their impact on your company’s overall objectives.

If your business is facing a dip in sales, you might have to allocate more resources to marketing initiatives. Your business can optimize the financial resources and enhance your competitive advantage by aligning budget allocations with strategic priorities.

Regular Monitoring

Businesses should conduct frequent financial reviews and compare actual performance against forecasted data. Your continuous monitoring ensures that the budget remains aligned with the evolving needs of the business and changes in the economy. As a business owner, you have to be prepared to adjust your budget in response to unexpected challenges.

Investing in Technology

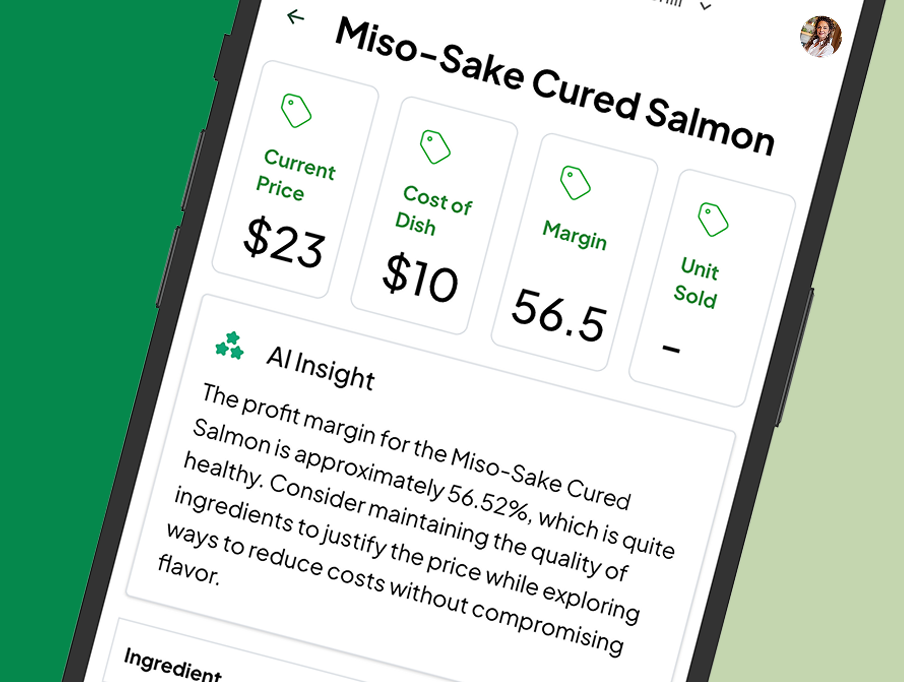

Using financial management software and tools to streamline the budgeting process is an excellent strategy. These tools can automate calculations and also provide real-time insights into financial performance. With features like forecasting analysis, you can make data-driven decisions and change your budget accordingly.

Creating An Emergency Fund

Managing potential financial problems can be tricky if you don’t prepare for them beforehand. This is why building an emergency fund within the budget is necessary. An emergency fund can be a financial lifesaver during economic downturns or financial crises.

Get Excellent Budgeting Software For Small Businesses

Looking to invest in top-notch budgeting software for your small business? You’ve come to the right place! At MRGN, our team offers the technological tools to help you make extensive budgets and create viable strategies for your business

So, what are you waiting for? Get in touch with our team for more details about our financial management and budgeting software.