If you’re an entrepreneur, it is crucial to have a comprehensive understanding of financial management to effectively navigate the world of business finance. This includes investing in smart budgeting tools such as financial software to create accurate and flexible budgets that align with their business goals.

In this comprehensive guide, we’ll explore the intricacies of smart budgeting, highlighting the importance of leveraging small business expense tracking software. Read on!

Importance of Smart Budgeting

Smart budgeting is the bedrock of a thriving business. It involves meticulous allocation of resources to optimize efficiency, maximize profits, and mitigate risks. As an entrepreneur, mastering the art of financial management will determine the sustainability and growth of your venture.

Key Steps in Smart Budgeting

Define Your Financial Goals

Before getting into your budget, clearly outline your short-term and long-term financial goals. Whether it’s expanding your product line, increasing market share, or achieving a specific revenue target, having well-defined objectives will guide your budgeting decisions.

Create a Detailed Budget

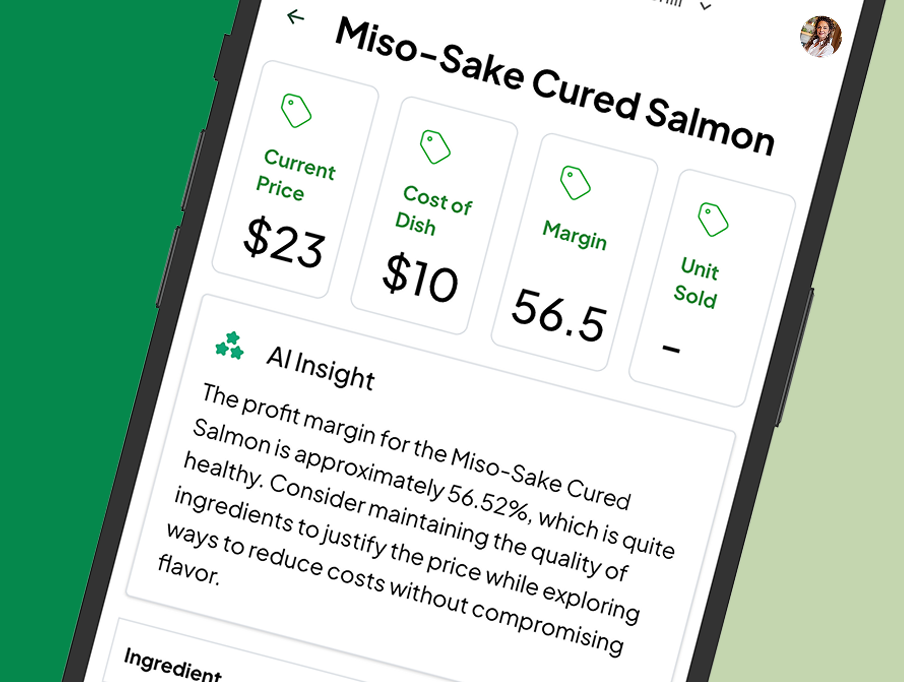

Develop a comprehensive budget encompassing all aspects of your business using cutting-edge small-business budgeting software. This tool allows you to categorize expenses, track cash flow, and maintain an overview of your financial commitments, providing a solid foundation for effective budget management.

Track and Monitor Expenses with Expense Tracking Software

Implement a robust system for tracking and monitoring your expenses. Small business expense tracking software automates this process, offering real-time insights into your financial statements. Regularly reviewing these reports allows you to identify areas for adjustment before they become problematic.

Prioritize Essential Expenses

In times of financial constraints, prioritize essential expenses using insights from your tracking software. Distinguish between critical operational costs and discretionary spending to make informed decisions and ensure vital aspects of your business remain unaffected.

Build a Contingency Fund

Establishing a contingency fund within your budget is crucial for unforeseen challenges. This reserve, coupled with the insights from your software, provides a financial safety net for unexpected expenses or economic downturns.

Negotiate Smartly

Enhance your negotiation skills, especially when using budgeting and forecasting software. Negotiate with suppliers, vendors, or service providers to secure favorable terms and prices, contributing significantly to cost savings and improved profitability.

Invest in Technology

Leverage technology further with budgeting and forecasting software. These tools provide advanced analytics and insights, empowering you to make data-driven decisions. Implementing accounting software and other technological solutions streamlines financial processes, reducing manual errors and improving accuracy.

Are you an entrepreneur with aspirations of financial excellence and success? You’ve come to the right place! At MRGN, you can benefit from small business expense tracking software, budgeting and forecasting software, and financial planning.

With the power of predictive intelligence, our affordable small business budgeting software brings tailored solutions for your business. You can efficiently navigate your business while we make budgeting, hiring, and all other complex aspects of your operations easier for you!

Revolutionize your approach with our financial planning and analysis software, designed for precision. Contact us now for more information!