Understanding Start-up Budgeting and Its Benefits

Start-up budgeting is a critical tool for any new business. It allows you to track your income and expenses, forecast your cash flow, and make informed financial decisions. Using budgeting software can help you keep track of your finances and ensure that you are on track to meet your goals.

There are a number of benefits to using start-up budgeting software. First, it can help you find ways to reduce your expenses and increase your revenue. Second, it can help you make informed decisions about your business. There are several different types of start-up budgeting software available, so it is important to choose one that is right for your business. When you are first starting out, it is important to keep your start-up costs low. One way to do this is to choose start-up budgeting software that is free or low-cost. There are a number of free and low-cost options available, so you should be able to find one that meets your needs.

Once you have chosen start-up budgeting software, you need to input your income and expense data. This data will help you track your progress and ensure that you are on track to meet your goals. Start-up budgeting software typically includes a number of different reports, so you can track your progress over time. Once you have inputted your data, you can start to see where your money is going. This information can be invaluable in helping you to find ways to save money and reduce your expenses. Start-up budgeting software can also help you to identify areas where you may be able to increase your revenue.

As your business grows, you may want to consider investing in more advanced start-up budgeting software. This software can provide more features and functionality, such as the ability to track inventory levels and sales data. More advanced software may also include features such as project management and time tracking.

No matter what type of start-up budgeting software you choose, it is important to use it regularly. By tracking your progress and monitoring your finances, you can ensure that your business is on track to meet its goals.

Identifying Your Business’s Financial Needs

Start-up budgeting software can help new business owners identify their business’s financial needs. Creating a budget is one of the most important steps in starting a new business. A budget will help you track your income and expenses, and it will also help you make informed decisions about how to allocate your resources. There are a number of different ways to approach start-up budgeting. One approach is to use a start-up budgeting template. This can be found online or in business software programs. Start-up budgeting templates will typically include categories for income and expenses, and they will often offer suggested expense amounts.

Another approach to start-up budgeting is to create your own budget from scratch. This can be done using a simple spreadsheet program like Microsoft Excel. When creating your own budget, be sure to include categories for all of your income and expenses. You may also want to include a category for long-term savings goals.

Once you have created a budget, you can use it to track your actual income and expenses. This will help you identify any areas where your spending is exceeding your income. It will also help you make adjustments to your budget as necessary.

If you are not sure where to start, there are many resources available to help you create a start-up budget. The Small Business Administration offers a number of helpful resources, including a start-up checklist and a budget worksheet. You can also find helpful information in business books and online.

Examining Different Start-up Budgeting Software Options

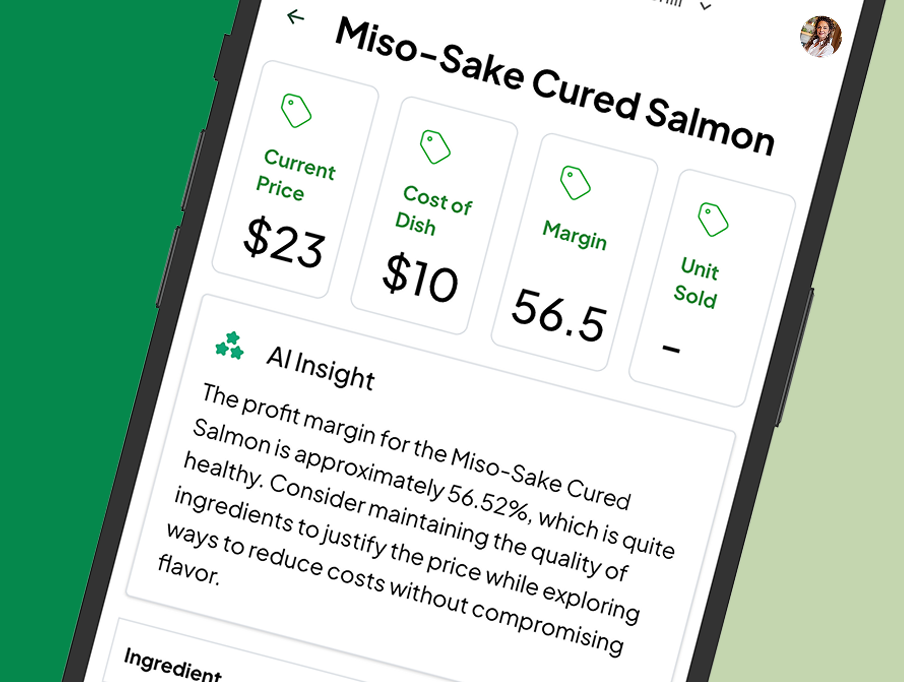

As a business owner, one of the most important things you can do is keep track of your finances and understand your business’s financial needs. This is especially important in the early stages of your business, when you are start-up budgeting and trying to control costs. There are a few key things to keep in mind when it comes to your business’s finances. First, you need to track all of your income and expenses. This will give you a good idea of where your money is going and what areas you can cut back on. Using tools like MRGN.AI can help in this process.

Second, you need to create a budget. This will help you keep track of your spending and make sure you are not overspending in any one area. Third, you need to understand your business’s tax obligations. This will ensure that you are paying all of the taxes you owe and that you are not underpaying. Fourth, you need to understand your business’s financial needs. This includes things like how much money you need to start up your business, how much money you need to keep your business running, and how much money you need to grow your business. Fifth, you need to understand your personal financial situation. This includes things like your income, your debts, and your assets. All of these things are important to understand when it comes to your business’s finances. By tracking your income and expenses, creating a budget, and understanding your financial needs, you can ensure that your business is on the right track financially.

Advantages and Disadvantages of Top Start-up Budgeting Software

Are you a startup looking for the best budgeting software? There are many advantages and disadvantages of the top software programs out there. Here are some things to consider before making your decision.

Advantages:

- Helps you keep track of your spending and save money.

- Easy to use and set up.

- Some programs offer features like tracking investments and expense reports.

- Can help you stick to your budget.

Disadvantages:

- May be expensive. It’s always good to check the pricing before making a decision.

- Requires some time to learn how to use the software.

- Some features may be unnecessary for your needs.

- Not all programs are compatible with all devices.

When choosing a budgeting software program, it is important to consider your needs and budget. There are many great programs out there, but not all of them will be right for you. Take the time to research your options and find the best software for your startup.

Comparing Features Between Different Start-up Budgeting Software

Start-up budgeting software is an essential tool for any business. It helps you track your expenses, income, and profit so you can make informed decisions about your business. There are many different types of start-up budgeting software on the market, and they all have different features. So, how do you know which one is right for your business? In this blog post, we’ll compare the features of the most popular start-up budgeting software to help you make an informed decision.

Choosing the Right Start-up Budgeting Software for Your Business

As a business owner, you know that one of the keys to success is effective budgeting and financial management. But with so many different software options on the market, how do you choose the right one for your business?

Here are a few things to keep in mind as you evaluate start-up budgeting software for your business:

- User-Friendliness: You want a software that is easy to use and navigate. It should have an intuitive interface that makes inputting and tracking data easy. For more on user-friendly interfaces, check out MRGN.AI’s features page.

- Flexibility: Look for software that is flexible and can be customized to meet your specific business needs. For more insights on customization, refer to this blog post.

- Reporting: The best budgeting software will offer robust reporting features that give you visibility into your financial data. For a deeper dive into financial data and its importance, read this article.

- Support: Choose a software vendor that offers quality customer support in case you have any questions or need assistance using the software. MRGN.AI’s support portal is a great resource for this.

- Cost: Of course, you’ll also want to consider cost when choosing budgeting software for your business. But don’t let price be the only deciding factor. Be sure to also consider the other factors on this list to make sure you’re getting a quality product that fits your needs. Always refer to the pricing page for the most up-to-date information.

Setting Up Your Start-up Budgeting Software

There are a lot of factors to consider when choosing the right start-up budgeting software for your business. Here are a few things to keep in mind:

-

- How much does the software cost? Obviously, cost is a major factor to consider when choosing any type of software for your business. However, it’s important to keep in mind that the most expensive software isn’t necessarily the best. There are plenty of great budgeting software options that are reasonably priced. Always check the pricing page to ensure you’re getting the best value.

- What features does the software offer? When it comes to budgeting software, there are a lot of different features that can be helpful. For example, some software lets you track your income and expenses, create budgets, and even set up alerts when you’re close to overspending. Make sure to consider which features are most important to you before making a purchase. MRGN.AI’s features page provides a comprehensive overview of what they offer.

- How easy is the software to use? You don’t want to end up with a complex piece of software that’s difficult to use. When comparing budgeting software options, be sure to read online reviews to get an idea of how user-friendly the interface is. MRGN.AI’s blog often features user testimonials and insights.

- Is the software compatible with your existing accounting software? If you already have accounting software, it’s important to make sure that the budgeting software you choose is compatible. This way, you can easily transfer data between the two programs. For more on compatibility and integrations, refer to MRGN.AI’s support articles.

- Does the software offer customer support? In case you run into any issues while using the software, it’s helpful to know that customer support is available. Before making a purchase, be sure to find out what kind of support is offered in case you need help using the software. MRGN.AI’s support portal is always available to assist.

Tips for Managing Your Start-up Budget with Budgeting Software

Start-ups are notoriously cash-strapped, which is why it’s so important to have a solid handle on your finances from the get-go. One of the best ways to do this is by using budgeting software to create and track your start-up budget.

Here are a few things to keep in mind when using budgeting software for your start-up:

- Make sure you input all of your start-up costs. This includes one-time costs like incorporation fees as well as ongoing costs like office rent and salaries. For a deeper understanding of start-up costs, check out this support article.

- Track your revenue and expenses religiously. This will help you identify areas where you’re spending too much or not generating enough revenue. MRGN.AI’s features page offers tools that can assist with this.

- Use forecasting tools to predict future cash needs. This will help you plan for upcoming expenses and avoid any nasty surprises down the road. For insights on financial forecasting, refer to this article.

- Create multiple scenarios in your budget. This will help you plan for different outcomes and be prepared for anything that comes your way. For more on scenario planning, see this support guide.

- Make sure your budget is flexible. As your start-up grows and changes, so too will your budget. Make sure you update it regularly to reflect any changes in your business. For tips on flexibility in financial planning, read this blog post.

Making the Most of Your Start-up Budgeting Software

If you’re like most entrepreneurs, you’re always looking for ways to save money and run your business more efficiently. One way to do this is to use budgeting software to manage your start-up budget. Here are some tips for using budgeting software to help you save money and run your business more effectively:

- Use budgeting software to track your expenses. This will help you see where your money is going and where you can cut back. For a comprehensive guide on expense tracking, visit this support page.

- Make sure you include all of your start-up costs in your budget. This includes things like office space, equipment, supplies, and marketing. For a detailed breakdown of start-up costs, check out this support article.

- Use budgeting software to create a realistic budget. Don’t underestimate your costs or overestimate your revenue. Be realistic about what you can afford and what you need to spend to get your business off the ground. For more on creating a realistic budget, refer to MRGN.AI’s blog.

- Use budgeting software to stay on track. Review your budget regularly to make sure you’re still on track. Make adjustments as needed to ensure you stay within your budget. For tips on staying on track with your budget, read this support article.

Choosing the Right Start-up Budgeting Software for Your Business

As a business owner, you know that one of the keys to success is effective budgeting and financial management. But with so many different software options on the market, how do you choose the right one for your business? Here are a few things to keep in mind:

- User-Friendliness: You want a software that is easy to use and navigate. MRGN.AI’s platform is designed with user experience in mind. Check out their features to see how they prioritize user-friendliness.

- Flexibility: Look for software that can be customized to meet your specific business needs. MRGN.AI offers a range of use cases to cater to various business requirements.

- Reporting: The best budgeting software will offer robust reporting features. Dive into MRGN.AI’s blog to understand how they emphasize data-driven insights.

- Support: Choose a software vendor that offers quality customer support. MRGN.AI’s dedicated support page is a testament to their commitment to assisting their users.

- Cost: While considering the price, also look at the value the software brings. MRGN.AI’s pricing page offers a transparent breakdown of their packages.

By evaluating these factors and leveraging resources like MRGN.AI’s knowledge base, you can make an informed decision about the right budgeting software for your business.