To navigate the challenges and opportunities that come with operating small businesses, small business owners must leverage financial models effectively. You can also benefit from cutting-edge tools such as small business expense tracking software, budgeting, and forecasting software.

In this blog, we explore the significance of smart financial models and the role these tools play in propelling small businesses toward sustainable success.

Understanding Financial Models

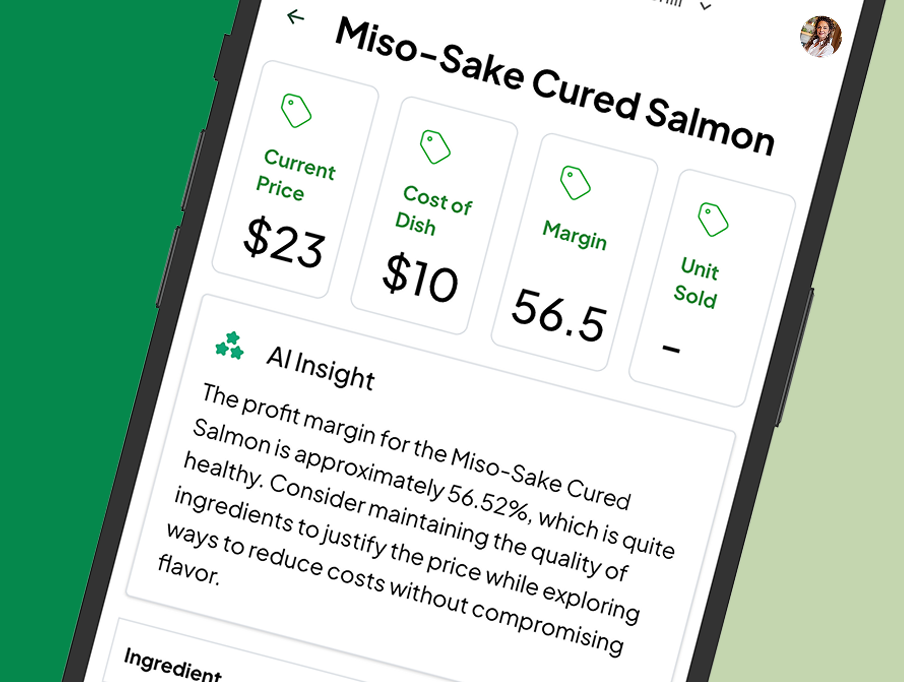

Financial models are analytical tools that provide a comprehensive view of a business’s financial health and future projections. These models incorporate various financial elements, such as revenue, expenses, cash flow, and profitability, to help business owners make informed decisions.

Benefits of Financial Models for Small Businesses

Risk Mitigation

Small businesses are inherently exposed to risks, and financial models act as a risk management tool. By identifying potential pitfalls and mapping out risk mitigation strategies, entrepreneurs can navigate uncertainties with confidence, safeguarding their businesses against financial setbacks.

Strategic Planning

Long-term success requires strategic planning, and financial models play a pivotal role in this process. With the support of budgeting and forecasting software, entrepreneurs can set realistic financial goals, map out growth trajectories, and ensure that their strategies align with the ever-evolving market dynamics.

Investor Relations

For small businesses seeking external funding or partnerships, a well-constructed financial model is indispensable. Investors and stakeholders often scrutinize financial projections, and the inclusion of small business budgeting software ensures accurate financial data, instilling confidence and showcasing meticulous planning.

Cash Flow Management

Efficient cash flow management is the lifeblood of small businesses. Financial models, coupled with small business expense tracking software, assist in predicting cash flow patterns. This enables entrepreneurs to allocate resources wisely, meet financial obligations, and seize opportunities for growth without jeopardizing liquidity.

Steps to Harness Financial Models for Small Business Success

Define Objectives and Key Metrics

Clearly articulate your business objectives and identify key performance indicators (KPIs) that align with these goals. This foundation will guide the construction of your financial model and the implementation of small business expense tracking and budgeting software.

Gather Accurate Data

Ensure the accuracy and relevance of the data used in your financial model. Reliable financial data forms the bedrock for trustworthy projections and analyses, a principle extended to small business expense-tracking software.

Choose the Right Model

Depending on your business type and industry, select a financial model that best suits your needs. Whether it’s a sales forecast, cash flow projection, or budgeting model, tailor it to your specific requirements and integrate budgeting and forecasting software for added precision.

Regularly Update and Revise

The business landscape is ever-changing, and so should your financial model. Regularly update and revise your projections based on actual performance and market trends to maintain accuracy, utilizing small business budgeting software for streamlined updates.

Seek Professional Guidance

If the intricacies of financial modeling seem overwhelming, don’t hesitate to seek professional assistance. Specialized software, such as small business expense tracking software, can provide invaluable support in creating and maintaining effective financial models.

If you’re looking for financial management solutions, you’ve come to the right place! With MRGN, you can streamline your small business budgeting, financial analysis, and planning with our software.

Elevate your organization with our affordable tools today. Contact now and make the most of our affordable small business budgeting software