Margins in the restaurant industry have always been tight, but lately, they’ve felt downright suffocating.

Between fluctuating food prices, tariffs, labor challenges, and the pressure to keep customers happy without raising prices too high, many restaurant owners are finding themselves in survival mode—wondering where the money goes, even on their busiest nights.

What if we told you that the answer might be hiding in plain sight? That beneath the prep tables, walk-in coolers, and daily specials lies a single metric that, if truly understood, could transform how you run your restaurant?

The metric is COGS—Cost of Goods Sold.

Now, before your eyes glaze over, let’s be clear: this isn’t an accounting lecture. It’s a wake-up call. Because calculating your COGS with precision isn’t just about good bookkeeping—it’s about unlocking real, measurable margin improvement that gives you breathing room to grow, invest, or simply exhale.

Let’s dive into what COGS really means, how to calculate it with clarity, and why the numbers behind your food matter more than you might think.

Why COGS Is the Unsung Hero of Restaurant Profitability

Cost of Goods Sold is the total cost of the ingredients and supplies you use to create the dishes and drinks you sell. It’s the actual money leaving your business to make your menu happen.

If your menu is your brand, COGS is the fuel keeping that brand moving. But here’s the problem: many restaurants track sales obsessively but barely glance at their COGS until something feels off. And by then, it’s often too late.

COGS tells you more than just how much your ingredients cost. It tells you:

- How efficient your inventory practices are

- Whether portion sizes are consistent

- If you’re pricing your menu to protect your margins

- Whether food waste or theft is eating into your profits

- And ultimately—how much money you’re actually keeping from what you earn

You can have a packed house and still lose money. We see it all the time. But when you know your COGS down to the decimal, you can spot leaks early and make smarter, faster decisions.

So How Do You Actually Calculate It?

Let’s simplify this. Here’s the standard formula:

COGS = Beginning Inventory + Purchases – Ending Inventory

Seems simple, right? But like a perfectly plated dish, the magic is in the prep.

Let’s say you started the week with $10,000 worth of ingredients in your kitchen. You bought $5,000 more during the week. By Sunday night, you’ve got $8,000 left in inventory.

So your COGS for the week is:

$10,000 (start) + $5,000 (purchases) – $8,000 (leftover) = $7,000

That $7,000 is the true cost of the goods you used to serve customers that week. If your sales for the week were $20,000, your COGS percentage is 35%.

Not bad. But could it be better? Absolutely—if you’re tracking precisely.

Where Precision Gets Lost (and Money Goes With It)

Here’s where many restaurants fall into the trap: they track inventory “when they can,” they don’t update pricing weekly, and no one’s really measuring what’s being wasted, spoiled, or over-portioned.

And we get it. You’re running a kitchen, not an accounting firm. But the truth is, when your COGS data is vague, your margins will be too.

Spoiled produce that never gets logged? That’s COGS.

Overpoured drinks or oversized portions? COGS.

Forgetting to account for vendor price hikes? You guessed it—COGS.

Precision requires process. It means counting inventory consistently, keeping recipes standardized, and tracking price fluctuations and waste in real time—not once a quarter when the bank account looks off.

Most of all, it means understanding that COGS isn’t a once-a-month task. It’s a living, breathing metric that tells the story of your restaurant’s financial health, every single day.

The Magic of Margins: What Happens When You Get COGS Right

Let’s talk about the why. Why put in the effort to tighten your COGS calculations?

Because it’s one of the fastest ways to improve your margins—without raising prices or cutting staff.

Let’s say your restaurant does $20,000 a week in sales. If your COGS is sitting at 35%, that’s $7,000 going to ingredients. But if you can bring that down to 30% through tighter inventory control, portioning, and menu adjustments?

You’re now saving $1,000 a week. That’s $52,000 a year.

That’s a new walk-in. A raise for your sous chef. A new marketing campaign. Or simply, peace of mind.

Margins aren’t improved in big, dramatic moves. They’re improved in the quiet, consistent discipline of tracking what you use, what you waste, and what each menu item is really costing you.

Menu Engineering Starts With COGS

You can’t design a profitable menu unless you understand your costs.

Let’s say you sell a lobster roll for $18. Sounds like a good price, right? But when you run the numbers, you realize the ingredients cost $12. With a 33% COGS target, that item is dragging you down.

Meanwhile, your $14 veggie wrap only costs $3 to make. That’s a goldmine.

Once you calculate item-level food costs and map them against sales, you start to see which items are margin leaders—and which are quiet liabilities.

This is where precision COGS becomes a strategy, not just a metric. You can:

- Promote high-margin dishes

- Reprice underperformers

- Adjust portion sizes

- Or even cut items that cost more than they earn

When COGS drives your menu decisions, profitability stops being a mystery—and starts becoming a repeatable system.

The Systems Behind the Numbers

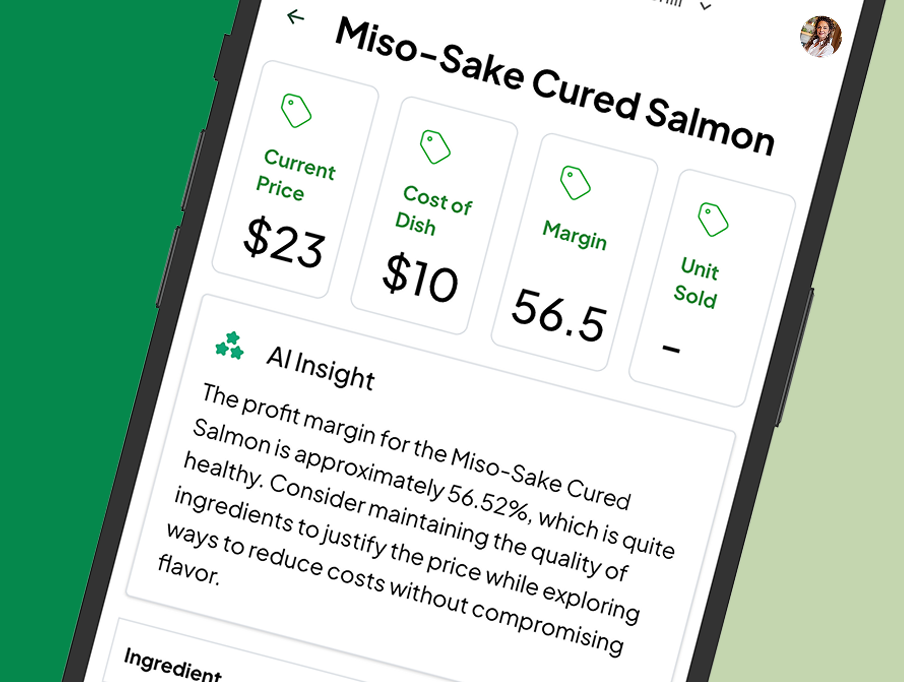

Let’s be real: most independent restaurants aren’t equipped with a full finance team. You’re wearing multiple hats already. That’s where tools like MRGN come in.

MRGN connects your POS and purchasing systems to bring real-time visibility to your COGS. It tracks inventory, monitors price shifts, and helps forecast whether you should increase headcount or cut back on costs—all without needing an accountant on staff.

But whether you use software or not, the principle remains the same:

Know your numbers, and they’ll guide you. Ignore them, and they’ll trip you up.

We’ve seen restaurants turn around six-figure losses just by understanding their COGS. It doesn’t happen overnight, but it starts with one decision: to treat your numbers like a partner, not an afterthought.

Progress Over Perfection

Here’s the truth: you won’t get your COGS perfect every week. And that’s okay.

But you don’t need perfection—you need progress.

Start small:

- Do weekly inventory counts on the same day each week.

- Create one standardized recipe per week.

- Track purchases more consistently.

- Educate your team about waste and portion control.

Over time, you’ll see the patterns emerge. You’ll spot red flags faster. You’ll make smarter menu decisions. And you’ll gain the confidence that comes from running your business—not guessing your way through it.

At MRGN, we’re not here to sell you another dashboard. We’re here to make financial clarity feel as natural as running a kitchen line. Because when your COGS is under control, so is your business.

And that? That’s when the magic happens.