In the ever-changing landscape of retail, economic downturns are inevitable. However, navigating economic uncertainty doesn’t have to spell disaster for your small or medium-sized business (SMB). With the right strategies, tools, and mindset, your retail business can not only survive but also thrive during a recession.

Understanding the Economic Landscape

Small businesses are the backbone of the American economy, representing a significant portion of the business landscape. However, the harsh reality is that many SMBs struggle during economic downturns. In fact, 80-90% of small businesses fail within 18-24 months of launching, with 82% attributing their downfall to a lack of business resources and tools.

So, how can your retail business defy the odds? The key lies in strategic financial management and leveraging the right resources. Here’s how you can navigate through economic turbulence and emerge stronger.

Embrace Financial Management Software

For many small business owners, financial management is a daunting task often approached with outdated methods. Managing finances with pen and paper or cluttered Excel files can lead to errors and inefficiencies. Transitioning to financial management software can be a game-changer, providing the tools and insights necessary to manage your finances effectively.

Simplified Financial Data

One of the biggest challenges small business owners face is understanding complex financial data. While graphs and charts can provide valuable insights, they are only useful if you know how to interpret them. Financial analysis software can simplify this process by interpreting data and presenting it in an easy-to-understand format, helping you make informed decisions that drive your business forward.

For example, a local boutique may struggle to track seasonal sales trends and manage inventory effectively. By using financial management software, the boutique owner can visualize sales data, identify peak seasons, and adjust inventory levels accordingly, reducing excess stock and minimizing waste.

Actionable Insights

In a recession, making data-driven decisions is crucial. Financial management tools provide actionable insights that enable you to understand your financial health and forecast future trends. This empowers you to take proactive steps to safeguard your business against economic uncertainties. The right tool can help you identify areas where you can cut costs, optimize operations, and focus on revenue-generating activities.

Consider a small electronics store facing declining sales during a recession. By utilizing financial analysis software, the owner can pinpoint which product lines are underperforming and which are still in demand. This insight allows the store to reallocate resources, focus marketing efforts on high-demand products, and negotiate better terms with suppliers to reduce costs.

Strategic Financial Planning

Effective financial planning is the cornerstone of any successful business, especially during a recession. Here’s how you can enhance your financial planning:

Budgeting for Success

Creating and sticking to a budget is vital in uncertain times. Budget management software allows you to create detailed budgets tailored to your business needs. By tracking expenses and revenues closely, you can ensure that your business remains financially stable even when times are tough.

For instance, a family-owned restaurant may use budgeting software to monitor daily expenses, labor costs, and food inventory. This helps the restaurant identify cost-saving opportunities, such as adjusting staffing levels during slow periods or negotiating better prices with suppliers.

Predictive Analytics

Many small business owners lack formal business education, which can make advanced financial planning seem out of reach. Predictive analytics tools can bridge this gap. By analyzing historical data, the right software can forecast future trends, helping you anticipate challenges and opportunities. This foresight is invaluable in making strategic decisions that keep your business on the right track.

A small fashion retailer, for example, can use predictive analytics to forecast sales based on past performance, seasonal trends, and market conditions. This enables the retailer to plan inventory purchases more accurately, reducing the risk of overstocking or stockouts.

Leveraging AI Technology

In today’s digital age, technology is a game-changer for small businesses. Artificial Intelligence (AI) can provide SMBs with capabilities once reserved for large enterprises. Here’s how AI-driven solutions can give your retail business a competitive edge during a recession:

Intelligent Automation

Time is a precious commodity for small business owners. AI technology can automate routine financial tasks, freeing up your time to focus on what you do best: running your business. From expense tracking to financial reporting, AI-driven software handles it all, ensuring accuracy and efficiency.

For example, a small home goods store can use AI to automate inventory management, track sales patterns, and predict reorder times. This reduces manual work and helps maintain optimal stock levels, preventing overstock and stockouts.

Enhanced Decision-Making

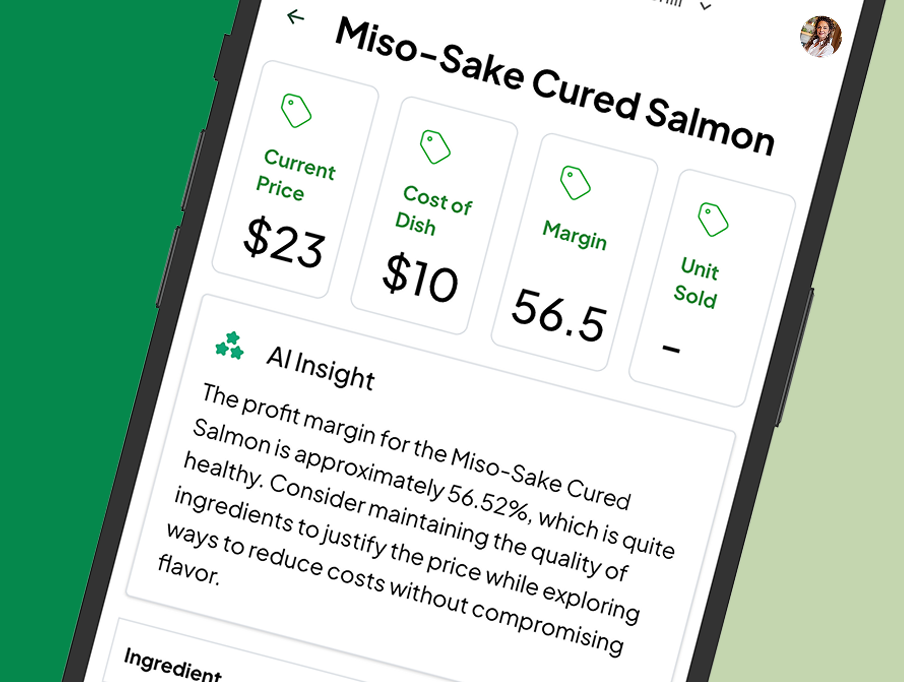

AI-driven insights can revolutionize your decision-making process. AI solutions analyze vast amounts of data to provide you with real-time recommendations. Whether it’s identifying the best time to launch a new product or determining optimal pricing strategies, AI-driven software helps you make decisions backed by data.

Consider a local bookstore leveraging AI to analyze customer purchase history and preferences. This information can be used to personalize marketing campaigns, recommend new arrivals, and optimize store layout to enhance the shopping experience and boost sales.

Cost-Effective Solutions

During a recession, managing costs becomes more critical than ever. Cost-effective financial management solutions tailored to the needs of small businesses can provide advanced financial analytics without the hefty price tag, making them accessible to all SMBs.

Maximizing ROI

Investing in financial management software is a smart decision, especially in a downturn. Such solutions offer a high return on investment by improving your financial management processes, reducing errors, and providing insights that drive profitability. By maximizing your ROI, you can ensure that every dollar spent contributes to your business’s success.

A small clothing boutique, for instance, can use financial management software to track marketing expenses and measure the ROI of different advertising campaigns. This allows the boutique to focus on the most effective marketing channels and optimize its budget.

Building Resilience Through Community

Economic uncertainty can be isolating, but you don’t have to navigate it alone. Building a strong network and community support can significantly impact your business’s ability to thrive during a recession. Here’s how you can leverage community resources:

Networking and Partnerships

Connecting with other small business owners can provide valuable insights and support. Consider joining local business associations, attending industry events, and participating in online forums. Sharing experiences and strategies with peers can help you discover new ways to overcome challenges and seize opportunities.

For example, a local farmer’s market vendor might partner with nearby businesses to create joint promotions, attract more customers, and share resources like marketing and logistics.

Support from Technology Providers

Many technology providers offer support beyond their software solutions. Engaging with these communities can provide additional resources, advice, and a sense of camaraderie among entrepreneurs facing similar challenges.

Adapting to Changing Consumer Behavior

Consumer behavior often shifts during a recession, and adapting to these changes is crucial for survival. Understanding and responding to your customers’ needs can help you maintain and even grow your business during tough times.

Focus on Value

During a recession, consumers tend to be more value-conscious. Offering high-quality products and services at competitive prices can attract budget-conscious customers. Consider bundling products, offering discounts, or creating loyalty programs to enhance perceived value and retain customers.

For instance, a local grocery store can implement a loyalty program that rewards repeat customers with discounts or special offers, encouraging them to continue shopping at the store.

Enhance Customer Experience

Exceptional customer service can set your business apart from competitors. Training your staff to provide excellent service, addressing customer concerns promptly, and personalizing the shopping experience can foster loyalty and encourage repeat business.

A small café, for example, can enhance the customer experience by remembering regular customers’ preferences, offering personalized recommendations, and creating a welcoming atmosphere.

Embrace E-Commerce

With the rise of online shopping, having a robust e-commerce presence is more important than ever. Investing in a user-friendly website, optimizing for mobile devices, and utilizing social media for marketing can expand your reach and attract new customers. Financial management tools can help you track and analyze your e-commerce performance, ensuring you make data-driven decisions to optimize your online strategy.

Consider a small handmade crafts store that expands its reach by setting up an online shop and using social media platforms to showcase products and engage with customers. This not only increases sales but also builds a loyal online community.

Conclusion: Thriving in Uncertainty

Navigating economic uncertainty is challenging, but with the right tools and strategies, your retail business can thrive even in a recession. By embracing technology, focusing on strategic financial planning, and adapting to changing consumer behavior, you can turn economic challenges into opportunities for growth.

Investing in financial management software can provide the insights and automation needed to streamline your operations and make informed decisions. Building a strong community network and enhancing your customer experience will further bolster your resilience.

Why MRGN?

At MRGN, we offer affordable financial management solutions designed specifically for small businesses. Our software simplifies financial data, provides actionable insights, and leverages AI technology to enhance your decision-making process. With MRGN, you can maximize your ROI and ensure your business thrives, no matter the economic climate.

Ready to take control of your financial future? Connect with MRGN today and unlock the full potential of your small business. Together, we can navigate economic uncertainty and achieve the success you know your business is capable of.