High-powered software is vital for small businesses, but it can also be a source of complexity, confusion, and cost. With so many tools and platforms available, small businesses must choose the right ones for their needs and avoid wasting time and money on unnecessary or redundant solutions.

Streamline Your Tech Stack Using Predictive Intelligence

Predictive intelligence for small businesses uses machine learning to predict future outcomes, identify trends, and shed light on the variables that could affect and optimize your decisions and actions.

By using predictive intelligence, small businesses can identify the most valuable and relevant tools and platforms for their goals and challenges while avoiding investing in solutions that are not aligned with their strategy or vision. They can also evaluate the performance and impact of their existing tools and platforms to identify any gaps, overlaps, or inefficiencies in their tech stack.

We must remember that predictive intelligence is not a magic wand that can solve all your tech stack problems. You also need to have a clear and realistic budget for your tech stack and manage your spending and ROI effectively.

This is where start-up budgeting and financial planning software comes in handy.

Business Budgeting Software For Tech-Stack Management

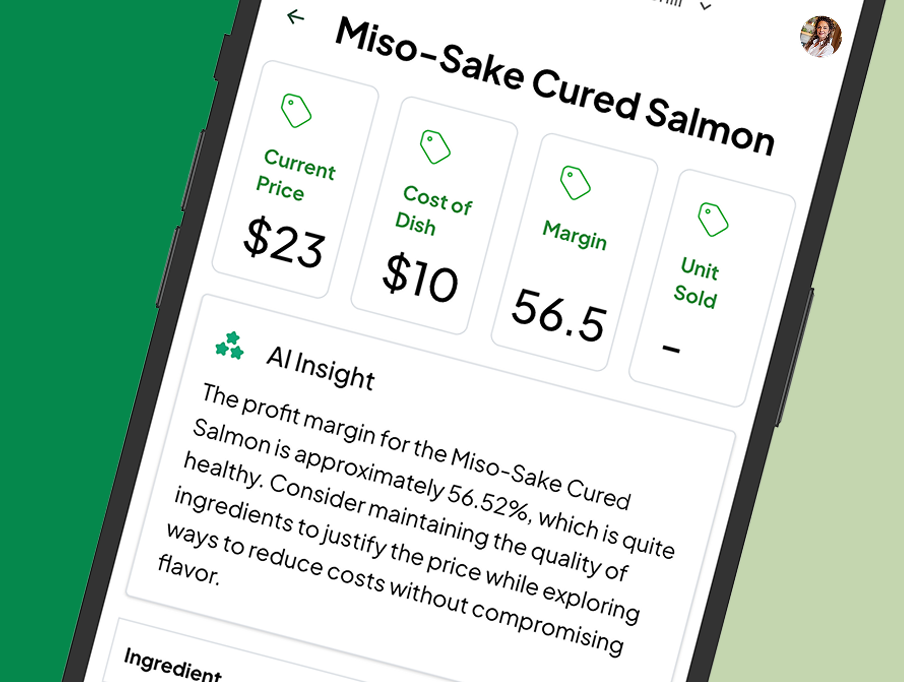

Business budgeting and financial planning software for businesses helps small businesses create, manage, and monitor their financial plans and goals. Small business budgeting software can also help SMBs with their tech stack decisions by allowing them to:

- Calculate the cost and benefit of various platforms and compare different scenarios and options.

- Determine the right balance of tools alongside the best timing and frequency to use them.

- Manage their subscriptions, licenses, and fees in line with their budgets

- Evaluate their investment to see the financial impact of their tech stack to optimize their strategy accordingly.

For SMBs, streamlining their tech stack for efficiency is an innovative and strategic move that shouldn’t be ignored. By using machine learning, start-up budgeting, and financial planning software for businesses, you, too, can choose the right tools and platforms for your needs and save time, reduce costs, and increase productivity.

The Best Small Business Budgeting Software Out There

Here are some points to consider when choosing the right business budgeting software:

- Understand your needs: such as budget creation, financial forecasting, reporting, data integration, and more.

- User-friendly, intuitive, and compatible with your existing tools and workflows.

- Compare pricing plans and value propositions before committing to a platform.

- Opt for cloud-based services that can be accessed from anywhere across devices.

- Understand the level of customer support, training, and documentation you will receive.

- Read the feedback and ratings from other end-users

For an all-in-one solution that checks all the right boxes, check out mrgn. Their affordable small business budgeting software has helped countless start-ups as well as established companies secure their future and pave the way to success.

Contact them to learn more about their financial management software for small businesses, or register here.