Running a restaurant is a complex mix of creativity and business savvy. While your passion may lie in crafting delicious dishes or creating a warm, inviting atmosphere, the reality is that staying profitable hinges on understanding the numbers. Budgeting might not be the most thrilling part of operating a restaurant, but it is essential for success.

Even the best restaurants encounter financial challenges. The key difference is that they are skilled at spotting potential issues early and making adjustments before small oversights escalate into significant problems. This proactive approach allows them to maintain smooth operations and continue delighting their customers.

For restaurant owners and managers who want to improve their financial management, tackling common budgeting hurdles is crucial. By doing so, you not only secure your restaurant’s financial health but also free up more time and energy to focus on what you love most—whether that’s innovating your menu, enhancing customer service, or creating an unforgettable dining experience.

In the following sections, we’ll outline practical strategies to help you navigate the financial side of running a restaurant. With these tools, you’ll be better equipped to balance culinary passion with sound fiscal practices, ensuring your establishment thrives in a competitive market.

Beyond rent and payroll, there are plenty of smaller costs that sneak up on restaurants—credit card processing fees, takeout packaging, maintenance costs, and subscription services. Over time, these little expenses add up to big numbers.

Keeping a Close Eye on Cost of Goods Sold (COGS)

What Happens:

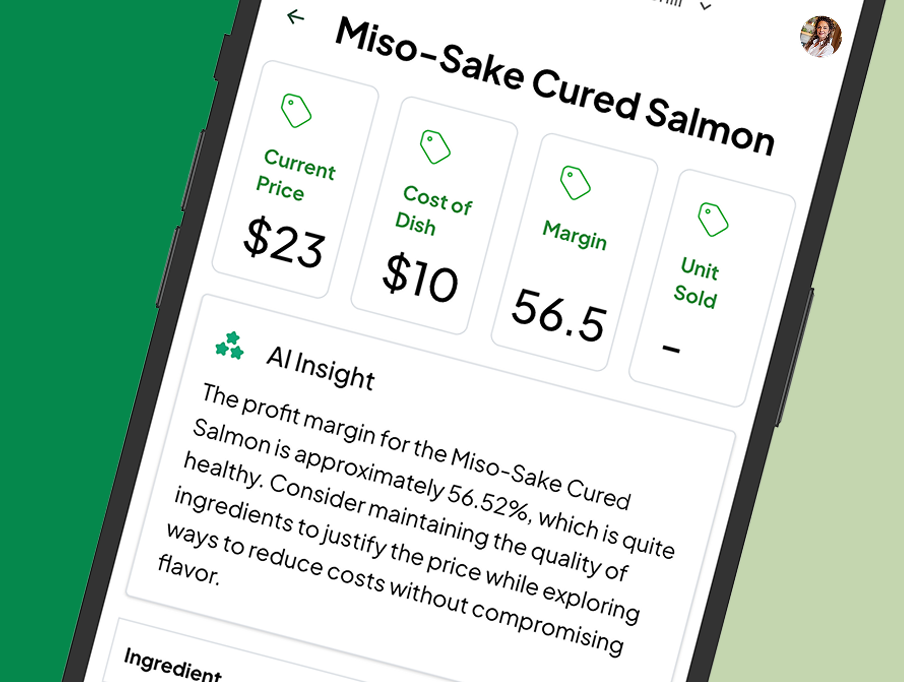

It’s easy to assume your sales numbers tell the full story, but if you’re not tracking your Cost of Goods Sold (COGS), you might not realize your profit margins are shrinking. Rising ingredient costs, waste, or inconsistent portioning can quietly eat away at revenue.

How to Stay Ahead:

Make it a habit to track COGS weekly, instead of waiting until the end of the month. With MRGN’s recipe costing software, you can automate cost tracking, identify trends, and get alerts when food costs start creeping up. This way, you can adjust portion sizes, negotiate supplier prices, or tweak your menu before margins take a hit.

Smart Tip:

If waste is a recurring issue, consider using a digital inventory system to track usage patterns and prevent over-ordering.

Balancing Labor Costs Without Sacrificing Service

What Happens:

Scheduling too many employees during slow hours leads to unnecessary payroll costs, while not having enough staff during peak times can hurt service and sales. Finding that perfect balance is tricky but essential.

How to Stay Ahead:

Instead of guessing, use data to forecast demand. Adjusting your schedule based on peak hours can make a significant difference in profitability.

Smart Tip:

Cross-train your staff so they can step into different roles as needed. This adds flexibility without increasing payroll costs.

Mastering Peak Hours

What Happens:

Peak hours, or “golden hours,” are critical time windows that can significantly impact a restaurant’s daily revenue. During these periods, restaurants can generate two to three times as much revenue per hour compared to slower times.

How to Stay Ahead:

Analyze your restaurant’s unique peak hours based on your type of establishment. For example, pizza restaurants often peak during dinner times and weekends, while casual dining spots may have two main peaks – lunch (11 a.m. to 2 p.m.) and dinner (6 p.m. to 9 p.m.). Use this data to optimize staffing and operations.

Smart Tip:

Implement dynamic scheduling to adjust staff levels based on anticipated demand. This ensures adequate coverage during peak hours without overstaffing during slower periods, helping to balance labor costs and service quality.

Managing Hidden Expenses That Add Up

What Happens:

Beyond rent and payroll, there are plenty of smaller costs that sneak up on restaurants—credit card processing fees, takeout packaging, maintenance costs, and subscription services. Over time, these little expenses add up to big numbers.

How to Stay Ahead:

Do a monthly expense audit to review where your money is going. MRGN helps highlight recurring costs, making it easy to spot unnecessary spending. If you notice an expense creeping up, renegotiate contracts or look for more cost-effective alternatives.

Smart Tip:

If your credit card processing fees are too high, see if your provider offers lower rates or explore offering discounts for cash payments.

Setting Menu Prices That Actually Work for You

What Happens:

Pricing menu items based on what competitors charge or what feels “right” can backfire. Without factoring in food costs, labor, and overhead, you might be underpricing (losing money) or overpricing (driving customers away).

How to Stay Ahead:

Use a structured approach to pricing. A simple formula is:

Menu Price = (COGS ÷ Ideal Food Cost Percentage) x 100

For example, if a dish costs $4 to make and your target food cost percentage is 30%, you should charge $13.33. MRGN automates this process with its food estimate calculator, ensuring your prices align with your financial goals.

Smart Tip:

Adjust menu prices gradually (3-5% at a time) to minimize customer pushback. Small increases are easier for guests to accept.

Preparing for Seasonal Changes in Sales

What Happens:

Every restaurant experiences seasonal shifts—summer surges, holiday spikes, and winter slowdowns. If you don’t plan ahead, you might find yourself overstaffed and overspending during slow months or scrambling to keep up when demand skyrockets.

How to Stay Ahead:

Look at past sales data to anticipate seasonal fluctuations and adjust your budget accordingly. MRGN’s forecasting tools help you prepare in advance, ensuring you don’t get caught off guard.

Smart Tip:

Introduce seasonal menu specials based on cost-effective ingredients to keep your offerings fresh without straining your budget.

Building an Emergency Fund for the Unexpected

What Happens:

A sudden equipment breakdown or an unexpected dip in sales can be devastating if you don’t have a financial cushion. Many restaurants operate on razor-thin margins, making unexpected expenses even riskier.

How to Stay Ahead:

Aim to set aside at least three months’ worth of operating expenses in an emergency fund. If that feels overwhelming, start small—just 1-2% of revenue each month—and build from there. MRGN’s cash flow management tools can help automate savings so you’re always prepared.

Smart Tip:

Plan for maintenance costs before something breaks. Regular upkeep on key equipment can prevent costly last-minute repairs.

Using Data Instead of Guesswork

What Happens:

Many restaurant owners rely on gut feelings when making financial decisions. But without data, it’s easy to misjudge inventory needs, overstaff, or miss opportunities to increase profitability.

How to Stay Ahead:

Use restaurant management software like MRGN to track key performance indicators, analyze trends, and make informed decisions. Real-time insights can help you react quickly and make smarter financial choices.

Smart Tip:

Set up automated alerts for important metrics like food cost percentage and labor-to-sales ratios so you’re always one step ahead.

Small Adjustments Lead to Big Wins

Every restaurant faces financial challenges, but the key to long-term success is knowing how to identify and fix them before they become major problems. The good news? You don’t have to do it alone.

MRGN gives restaurant owners the tools they need to manage costs with its recipe costing software, forecast expenses with its food estimate calculator, and optimize profitability—without the need for a CFO. Book a demo to learn more.